After years of practicing family law, you start to notice some of the misconceptions clients have when they ask to get a divorce. Even the most well-researched and prepared client can be caught off-guard by the realities of getting a divorce. Before filing your suit, here are seven things to be aware of or do so that you are knowledgeable and ready to proceed.

There are no winners or losers.

Remember – this is a family law case, not a personal injury lawsuit or a criminal case. Thanks to the ubiquity of television, there is a certain expectation of what a trial or lawsuit is. In family law, it is different. Divorcing spouses will rarely end up with all the property they want, or full custody of the children. The court must balance the interests of the parties with that of the child, and always consider what is fair under the circumstances. Don’t file your divorce with the idea that you are going to ‘beat’ your spouse. You are setting yourself up for a long battle. Rather, come in with the idea that you need to negotiate a final settlement. Perhaps you weren’t that great at negotiating with your spouse while you were married? That’s where number 2 comes in.

You should really get a lawyer. Really.

Sure, you can absolutely file for divorce on your own. I might be biased, but it is much better to hire a lawyer to help you, especially if your case is contested. First, there are very specific procedural rules and timelines that must be followed. Failure to do so could result in the dismissal of your case entirely. You may also not understand the complexities of property division or custody determinations. A divorce deals with the two most important things in your life: children and money. Why would you leave it up to chance?

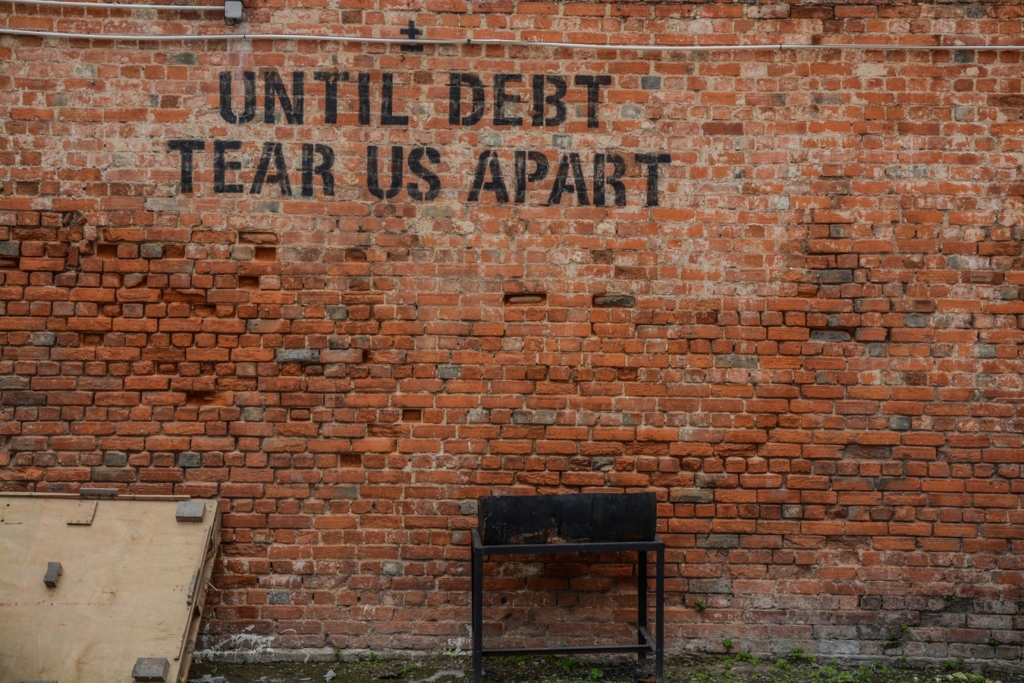

Lawyers can be expensive, it’s true. But if you have ever bought a new TV with a credit card, then you have no excuse not to hire a lawyer. Get a loan if you have to. It can be more expensive in the long run if you don’t invest now. Even in uncontested cases, a lawyer can ensure that all your paperwork is correct, that the property division is enforceable, and that property is actually transferred. I have had several clients come to me after their DIY divorce is finalized only to find out that their share of their spouse’s retirement was drafted incorrectly, and they are left with nothing. Do not take the chance – hire a lawyer.

Your friends aren’t you.

It’s tempting to speak to friends or family members who have been through their own divorce. But every family and their dynamics are different. What might have worked for one party may not work for you. A decision may have been made in one case due to completely different facts and circumstances. Remember – your friends are not lawyers (well, probably) and what was best for their family may not be best for yours.

Start a nest egg.

Divorce is expensive – even if you go DIY. Your spouse’s income is now going somewhere else. Whatever assets you have are generally divided up. State courts often do not award spousal support unless the other party can show a significant need. It is a good idea to start a small nest egg to make ends meet while litigation is pending and after the divorce. Yes, this will be considered community property and could be divided. However, it is better to be prepared than not.

Try to have between 3-6 months of your living expenses saved up before filing for divorce. This can be a lifesaver if your spouse is greedy and empties the bank account or takes you off credit cards. Open up your own, separate account and start depositing money in – somewhere they cannot liquidate it without your knowledge. If you are afraid they will empty out your joint accounts, then take half of each account and put it in your own separate one. Try not to spend the money you withdrew if at all possible. Of course, if all the bills come out of that account each month and there is not a lot left, this will not be a good option. The last thing you need is utility companies cutting off your power or incurring fees for bounced checks.

Understand your finances.

So many clients have come in while we are preparing their inventories without a clue as to their spouse’s income, debts, or other property. If this sounds familiar, then before you file for divorce, take stock. A good place to start is your latest tax returns. This will show each spouse’s income, any business interests, rental income and real property. Keep a copy of this and bring it to your attorney.

Start keeping track of how much bills cost each month, what bank accounts your spouse has, whether or not they have any outstanding debt and its value. Even though many cases will allow for discovery and require spouses to disclose their financial situations, you do not want to rely on the honesty of your spouse in a divorce. Gathering up the information that will be important before you file for divorce will at least give you a better understanding of what you can expect in the way of settlement, and how much it costs to run your household.

Figure out how to tell the kids.

Should you and your spouse sit down together with the kids? Maybe one parent is better at delivering the sad news. Do not be afraid to seek out the advice of a professional to give you some guidance. There are plenty of resources in books and online about the best way to tell children their parents are divorcing. Try to avoid telling them on birthdays or on major holidays, like Christmas. Remind them that it is the parents who are divorcing – not the kids – and reassure them that they are loved and you and your spouse will co-parent and raise them together – and follow through on this.

Regardless, you and your spouse must be on the same page when it comes to delivering the news. Remember, you can always try a period of separation first to determine if you and your spouse cannot reconcile. This might also help the kids adjust to a new normal. Speaking of…

There will be a waiting period.

Many times, clients will come in with a settlement agreement, wanting to sign divorce papers today. Most states have a waiting period – some as little as 30 days, and some up to a year or 18 months. Make sure you understand this. That does not mean that you cannot live separate and apart and begin moving on. During the separation, you and your spouse should agree to temporary orders concerning the use of property, accounting, support, custody, and possession of the children.

The state has an interest in preserving the family unit, so there is typically a mandatory waiting period that allows the parties to reconcile. Use this opportunity to make sure you can afford your lifestyle and that you and your spouse are working together to raise your children before signing off on a final order. Try to avoid making any major purchases during this period (remember, it might still be community property). If the temporary orders appear to work, then it is easy to formalize them into the final decree.

There is a lot more to be aware of in a divorce, not least of all that it will be difficult, even in the most amicable of circumstances. Make sure you have a good support system in place with family and friends, don’t be afraid to seek out counseling or therapy, and seriously? Get a lawyer.